Thinking about your financial future, especially what your retirement might look like, can feel a bit like looking into a crystal ball, yet it does not have to be a guessing game. Many people, so it seems, wonder just how much money they will have saved up when they stop working. That is where a helpful tool, the dave ramsey investment calculator, comes into play. It gives you a pretty good idea of what your money could do over time, and it is inspired by Dave Ramsey's sensible financial ideas.

This particular tool is, in a way, specifically put together to help folks look at their money plans and make smart choices. You see, it is an online helper that lets you figure out potential growth for your savings. It really shows you what you might have in your retirement fund as the years go by. It is all about helping you see a clearer path ahead.

We are going to walk through what this calculator does, how you can use it, and why it matters for your financial dreams. We will talk about how it helps you figure out exactly how much to put aside each month to hit those big money goals, all by using the powerful idea of compound interest. So, let us get into how this very useful tool works for you.

Table of Contents

- About Dave Ramsey: A Financial Guide

- What is the Dave Ramsey Investment Calculator?

- Why Think About Your Investments?

- How to Use the Dave Ramsey Investment Calculator

- The Magic of Compound Interest

- Key Benefits of This Tool

- Tips for Getting the Most from the Calculator

- Common Questions About the Calculator

- Beyond the Calculator: Your Next Steps

- Conclusion: Plan Your Future Today

About Dave Ramsey: A Financial Guide

Dave Ramsey is a pretty well-known personal finance expert. He has spent many years helping people get their money in order, especially when it comes to getting out of debt and building wealth. His advice, you know, often focuses on common sense steps and a firm belief in living debt-free. He has written books, hosts a popular radio show, and has built a whole program around teaching people how to manage their money better.

His approach to money is, in some respects, quite direct. He talks a lot about saving, investing, and giving. The tools he offers, like the dave ramsey investment calculator, come from these core ideas. They are made to be simple and easy for everyday folks to use, helping them see their financial possibilities without a lot of confusing terms. It is about giving people the ability to take charge of their own money story.

Dave Ramsey Personal Details

| Detail | Information |

|---|---|

| Full Name | David Lawrence Ramsey III |

| Known For | Personal Finance Expert, Author, Radio Host |

| Approach | Debt-free living, common sense financial principles |

| Tools Provided | Budgeting forms, investment calculators, financial courses |

What is the Dave Ramsey Investment Calculator?

The dave ramsey investment calculator is a free online tool that comes from the personal finance expert himself, Dave Ramsey. It is basically a way for anyone to guess how much their money might grow over time if they put it into investments. You can access this particular investing calculator at the link provided, which is quite handy.

This online helper lets you see what your savings could turn into, and it is pretty straightforward to use. It takes into account a few pieces of information you put in and then shows you a projection. It is, you know, a way to help you think about your future money and make plans for it. This tool is, like, really about helping you get a picture of what is possible.

It is made to help people look at their investment plans and then, you know, make smart choices about what they are doing. This specific Dave Ramsey calculator can help you figure out how much your money will be worth once you stop working and how you might even increase it. It is a very practical way to look ahead financially.

Why Think About Your Investments?

Thinking about where your money goes and how it grows is, honestly, a big part of building a secure future. Many people put off thinking about investments because it seems, well, a bit complicated. But, you know, planning for your money to grow is really important for things like retirement, buying a home, or even just having a comfortable life later on.

When you start putting money into investments, you are basically putting your money to work for you. It is like planting a seed and watching it grow into a tree, but with money. This process, which we will talk about more, can make a huge difference in how much wealth you build over the years. It is, in a way, about making your money earn more money.

Without a plan, it is hard to know if you are putting aside enough or if your money is doing its best. A tool like the dave ramsey investment calculator helps clear up that uncertainty. It gives you a clear number to aim for, which can make the whole idea of saving feel much more real and achievable. It is, sort of, your personal financial forecast.

How to Use the Dave Ramsey Investment Calculator

Using the investment calculator is simple, really. It is designed to be easy for anyone to pick up and use, which is great. You do not need to be a financial wizard to get some good information from it. It guides you through a few steps to get your projection.

First, you need to enter your initial investment. This is the money you are starting with, the amount you already have put aside. So, you just type in that number. It is, like, your starting point for the whole calculation.

Next, to start the calculation, you enter your current age. Then, you put in the age you plan to retire. These two numbers give the calculator a timeline to work with. It needs to know how many years your money has to grow, you see.

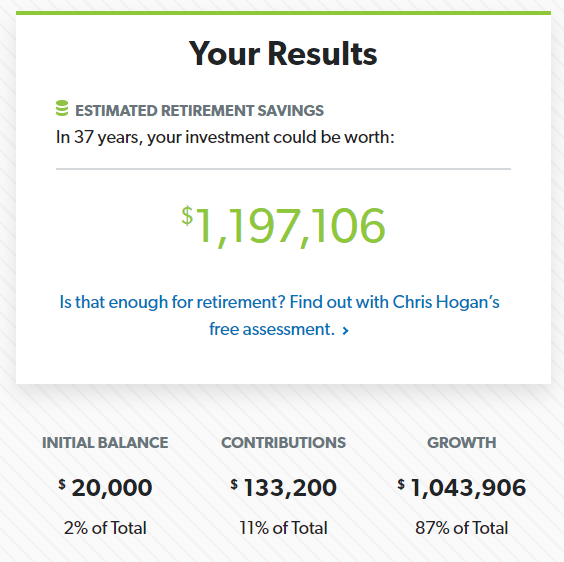

You will also put in how much you plan to add to your investments each month, or perhaps each year. This is your regular contribution. And, you will put in an expected rate of return, which is how much you think your investments will grow each year. This is, you know, usually an estimate based on historical averages, not a guarantee. Once you have put all that in, the calculator does its job and shows you what your money could look like.

The Magic of Compound Interest

One of the biggest ideas behind the dave ramsey investment calculator, and really all long-term investing, is something called compound interest. It is often called the "eighth wonder of the world" for a good reason. Basically, it means your money earns money, and then that new money also starts earning money. It is like a snowball rolling downhill, getting bigger and bigger.

Think about it this way: you invest some money, and it earns interest. Then, the next year, you earn interest not just on your original money, but also on the interest you earned the year before. This process, you know, keeps repeating. Over many years, especially when you are looking at retirement savings, this can make a huge difference. It is why starting early with investing is so often talked about.

The calculator uses these proven compound interest principles to show you how much your money could grow. It helps you find exactly how much to invest monthly to reach any financial goal you have. This means it is not just about guessing; it is about seeing the real potential of your money working for you over time. It is, truly, a powerful concept to understand.

Key Benefits of This Tool

There are several really good things about using the dave ramsey investment calculator. For one, it helps you get a clear picture of your financial future. It takes away some of the guesswork and replaces it with actual numbers you can look at. This can make planning feel much less scary, you know.

The calculator is specifically made to help people look at their investment plans and make smart decisions. It is not just about seeing a number; it is about understanding what that number means for your life. This online tool offers a user-friendly way to do that, which is very helpful for many people.

It also helps you set realistic goals. If you want to have a certain amount of money by retirement, the calculator can show you what you need to do each month to get there. This means you can adjust your saving habits now to meet your future needs. It really helps you connect your present actions with your future outcomes, which is quite important.

Moreover, it is a free tool. You do not have to pay to use it, which is a big plus for anyone trying to manage their money. It is an accessible resource for everyone, which is, honestly, a great thing for financial education. It helps you calculate the worth of the investment once you retire and how much you can increase it.

Tips for Getting the Most from the Calculator

To get the best information from the dave ramsey investment calculator, there are a few things you can keep in mind. First, be as accurate as you can with your numbers. Your current age, planned retirement age, and how much you can invest regularly will make the projection more useful. Garbage in, garbage out, as they say, so accuracy is key.

Consider trying different scenarios. What if you save a little more each month? What if you retire a few years later? Playing with these numbers can show you how much impact small changes can have over time. It is, like, a way to experiment with your financial future without any real risk.

Also, think about the expected rate of return you use. While past performance does not promise future results, looking at historical averages for the type of investments you are considering can give you a reasonable number. You might want to use a slightly conservative estimate to be on the safe side, which is often a good idea for planning. You can, for instance, check out information on average stock market returns from a reputable financial site to get a general idea.

Remember, the calculator gives you an estimate. It is a powerful planning tool, but it is not a guarantee. Life happens, and investment returns can go up and down. Use it as a guide to motivate your saving, not as a promise of exact future wealth. It is, truly, a starting point for your money journey.

Common Questions About the Calculator

People often have questions about how these kinds of tools work, and the dave ramsey investment calculator is no different. One common question is whether the calculator is truly free to use. Yes, it is a free online tool provided by personal finance expert Dave Ramsey. There is no cost to access it and get your projections, which is pretty nice.

Another thing people wonder about is what information they need to put into the calculator. As we mentioned, you will need your current age, the age you plan to retire, your initial investment amount, and how much you plan to add regularly. You also need an estimated annual rate of return for your investments. That is, more or less, all the main bits of information it asks for.

Folks also ask about how accurate the calculator is. The calculator provides an estimate based on the numbers you provide and the principles of compound interest. It is a projection, not a guarantee, because real investment returns can vary. However, it is very accurate in showing the potential growth given your inputs and helps you understand the impact of time and consistent saving. It is, you know, a very good planning tool, even if it cannot predict the exact future.

Beyond the Calculator: Your Next Steps

Using the dave ramsey investment calculator is a fantastic first step, but it is just that: a first step. Once you have a clearer idea of your potential future wealth, the next thing is to put a plan into action. This means actually starting to save or increasing your current savings. It is about moving from thinking to doing, which is pretty important.

Consider setting up automatic transfers from your checking account to your investment account. This makes saving consistent and takes the decision out of your hands each month. It is, like, paying yourself first. Also, review your investment strategy regularly to make sure it still fits your goals and comfort level with risk. Things change, you know, so your plan might need a little tweak now and then.

Remember, building wealth takes time and patience. There will be ups and downs in the market, but sticking to your plan is often the best way to see long-term growth. The calculator gives you a roadmap, but you still have to drive the car. It is, truly, about consistent effort over many years.

Conclusion: Plan Your Future Today

The dave ramsey investment calculator is a really helpful tool for anyone who wants to get a handle on their financial future. It shows you the power of compound interest and helps you figure out what you need to do to reach your money goals. By putting in a few simple numbers, you can see how much your money could grow over time, which is very motivating.

It is all about giving you the information to make educated decisions and assess your investment plans. This free online tool lets you estimate potential investment growth, showing you how much you can expect to have in your retirement portfolio. It helps you find exactly how much to invest monthly to reach any financial goal using proven compound interest principles. So, go ahead and use this tool to start planning your financial future today.

Detail Author:

- Name : Grant Rowe

- Username : kessler.lois

- Email : marie50@terry.com

- Birthdate : 1975-08-11

- Address : 367 Priscilla Estate Lake Sallie, AZ 92882-1905

- Phone : 360.509.2894

- Company : Stoltenberg-VonRueden

- Job : Fishing OR Forestry Supervisor

- Bio : Repellat non dolore quis qui ad eum ut. Quam dolores laborum optio.

Socials

tiktok:

- url : https://tiktok.com/@schroeder1971

- username : schroeder1971

- bio : Ipsam laborum dolore rerum impedit.

- followers : 5532

- following : 2952

instagram:

- url : https://instagram.com/lilla_schroeder

- username : lilla_schroeder

- bio : Et possimus harum omnis iusto aperiam aut. Iste similique nemo similique impedit consequatur quia.

- followers : 2486

- following : 582

twitter:

- url : https://twitter.com/lilla1904

- username : lilla1904

- bio : Saepe minima accusamus omnis accusantium atque non est. Voluptate eaque quam sed quidem voluptatum nisi architecto. Illum qui quo assumenda est et.

- followers : 4717

- following : 636

linkedin:

- url : https://linkedin.com/in/lillaschroeder

- username : lillaschroeder

- bio : Error quam et et fugit deleniti.

- followers : 6768

- following : 358